Top Benefits of Using Financial Service

In today’s dynamic economic environment, navigating personal and business finances can be both challenging and overwhelming. The complexity of modern money management has made professional financial services indispensable. By understanding the benefits of using finance, individuals and organizations alike can unlock opportunities that were previously out of reach, optimize resources, and achieve long-term financial stability.

Streamlined Financial Management

One of the most significant benefits of using finance is the ability to streamline financial operations. Whether it’s budgeting, investment planning, or debt management, financial services offer structured solutions that save time and reduce stress. Advanced digital platforms provide intuitive interfaces, real-time monitoring, and automated processes, allowing users to focus on strategic decision-making rather than routine administrative tasks.

Strategic Investment Opportunities

Accessing expert guidance opens doors to strategic investment opportunities. Financial service providers offer insights into market trends, risk management, and portfolio diversification, enabling clients to gain more with finance. Through tailored advice, individuals can maximize returns, minimize potential losses, and capitalize on high-growth opportunities that align with their risk appetite and long-term goals.

Enhanced Financial Security

Security is a cornerstone of effective financial management. Professional services ensure that assets, accounts, and investments are monitored meticulously. By leveraging sophisticated security protocols and personalized advisory support, clients mitigate risks and safeguard their wealth. This enhanced level of protection underscores why services matter, particularly in an age of digital transactions and evolving cyber threats.

Simplified Access to Credit and Loans

Financial service providers streamline access to credit and loans, enabling smoother personal and business financing. Whether it’s acquiring a mortgage, securing a business loan, or managing credit lines, these services offer structured pathways with competitive interest rates and flexible repayment options. Understanding top reasons to switch to professional financial services often revolves around these advantages, as users gain efficiency and clarity in managing their borrowing needs.

Tax Planning and Optimization

Efficient tax planning can yield substantial financial benefits. Expert guidance ensures that individuals and businesses comply with tax regulations while taking advantage of legal deductions and credits. The knowledge and expertise provided through financial services reduce errors, optimize taxable income, and ultimately allow clients to gain more with finance. This proactive approach can transform yearly tax obligations into strategic financial planning opportunities.

Personalized Financial Advice

Not all financial goals are identical. Tailored financial advice is one of the most compelling benefits of using finance. Professionals assess unique circumstances, risk tolerance, and objectives to craft bespoke solutions. From retirement planning to education funding, personalized guidance ensures that each client follows a roadmap suited to their specific needs, providing clarity and confidence in decision-making.

Convenience and Time Savings

Time is a critical resource, and financial services excel in offering convenience. Automated reporting, mobile banking, and real-time account management streamline complex tasks. Clients who embrace professional support discover that they can allocate more time to strategic pursuits, creative endeavors, or personal priorities. Recognizing why services matter often comes down to the efficiency and peace of mind that these solutions provide.

Business Growth and Expansion

For organizations, leveraging professional financial services can accelerate growth. By optimizing cash flow, managing payroll, and assessing investment opportunities, businesses can make informed decisions that drive expansion and profitability. Understanding top reasons to switch to specialized financial management often centers on the tangible outcomes of improved efficiency, reduced overhead, and strategic foresight.

Building Long-Term Financial Confidence

Long-term financial confidence stems from knowledge, preparedness, and the ability to respond to unexpected challenges. By integrating professional guidance, clients gain a structured approach to budgeting, saving, and investing. These foundational strategies highlight why services matter, creating a resilient financial framework that withstands economic fluctuations and market volatility.

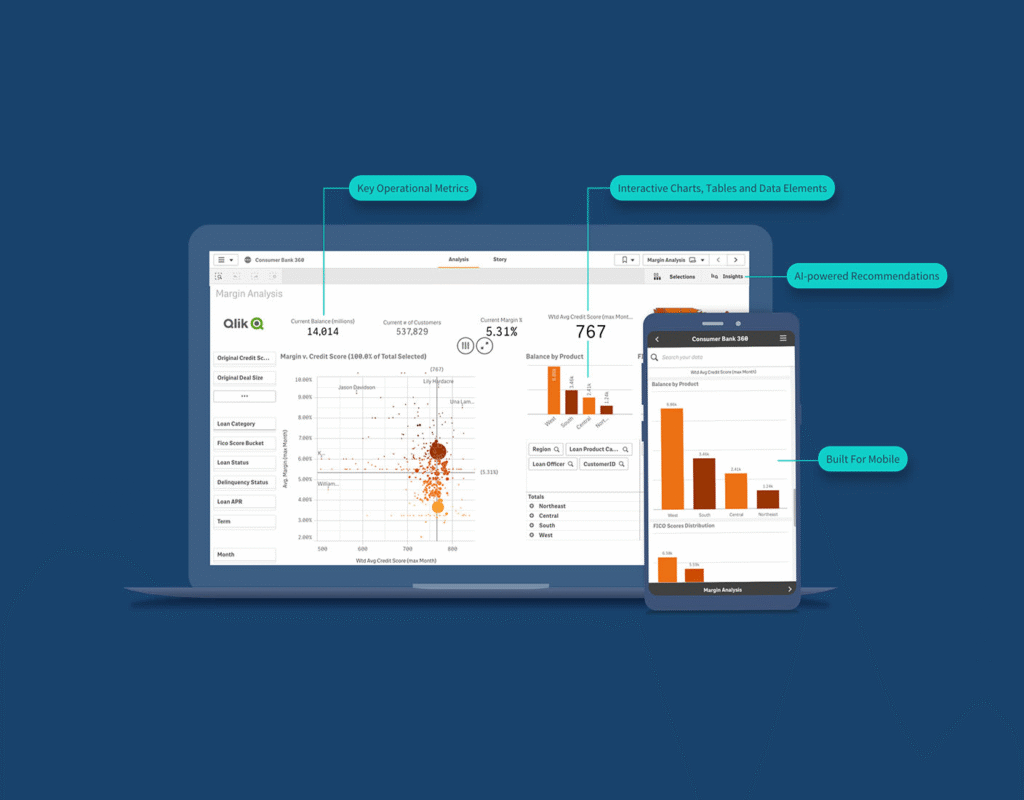

Access to Innovative Financial Tools

Modern financial services equip clients with cutting-edge tools, from AI-driven investment platforms to comprehensive analytics dashboards. These innovations allow for predictive modeling, scenario planning, and real-time insights. Individuals and organizations alike can gain more with finance by leveraging these sophisticated tools to make informed decisions and capitalize on emerging trends.