Winning Moves in Financial Service Today

The financial world has never been more dynamic. Technology, innovation, and shifting consumer expectations have reshaped the way people manage, spend, and invest their money. In this evolving landscape, understanding the right moves ensures not only security but also growth. By practicing calculated strategies and embracing modern tools, individuals and businesses alike can achieve remarkable financial outcomes.

Understanding the New Financial Terrain

The first step toward winning in financial service is recognizing that the traditional methods of money management are no longer sufficient. While savings accounts and conventional banking still play a role, the real momentum lies in digital platforms, customized services, and proactive planning. Today’s financial landscape demands agility—adaptability in both mindset and practice.

Institutions and individuals who thrive in this environment do so by blending old-world prudence with new-world innovation. They cultivate resilience, using tools that not only protect wealth but also allow it to flourish.

Today’s Smart Money Moves

Practicality is the foundation of financial success. Making today’s smart money moves does not require elaborate tactics—it often begins with small, disciplined choices. Simple actions like setting clear budgets, automating bill payments, or consolidating debt into manageable streams can create a ripple effect of stability.

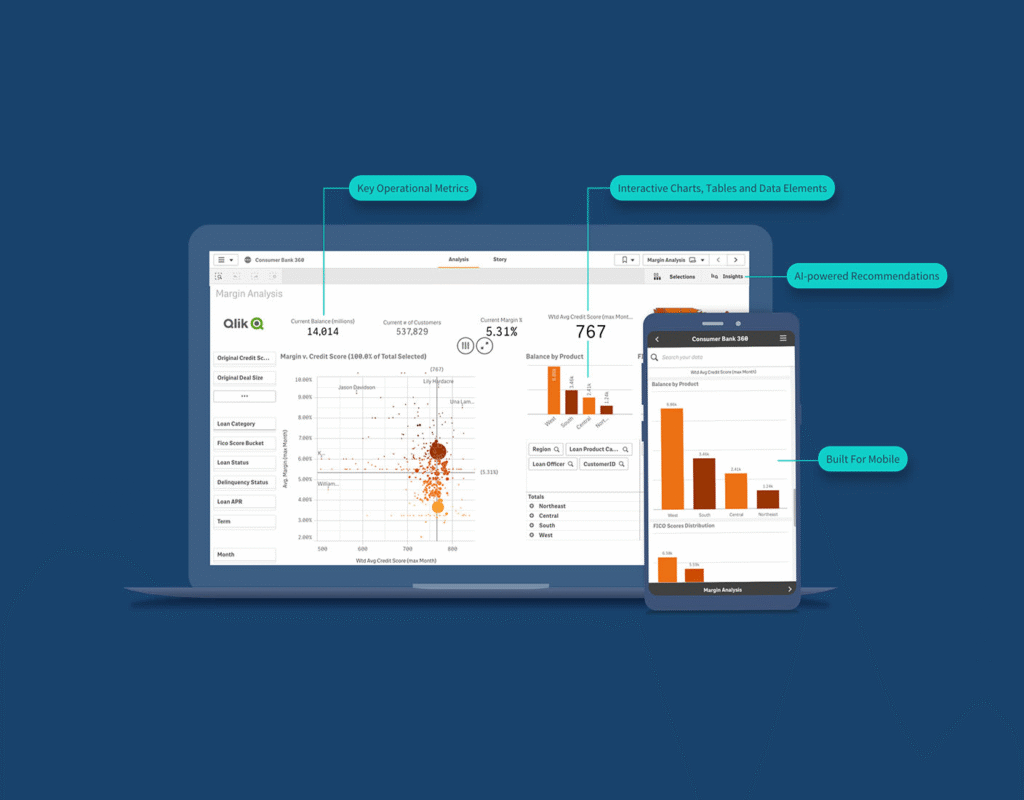

Another powerful move is leveraging financial technology. Apps that track spending in real-time or platforms that provide instant access to investments make decision-making faster and more accurate. Furthermore, diversifying income streams—through side projects, investments, or digital ventures—adds layers of security.

These small yet powerful moves accumulate into momentum, ensuring that money works as diligently as its owner.

Crafting Finance Success Strategies

Strategic thinking separates financial survivors from financial achievers. True resilience lies in developing comprehensive plans that anticipate not only present needs but also future aspirations. Effective finance success strategies encompass saving, investing, protecting, and scaling wealth.

One indispensable approach is the principle of diversification. By spreading investments across industries, geographies, and asset types, individuals reduce risk while amplifying potential rewards. Equally important is the art of goal alignment—ensuring that every financial decision corresponds with long-term objectives, whether that’s homeownership, retirement readiness, or entrepreneurial expansion.

Another crucial tactic is prioritizing education. Financial literacy has become a core competency, enabling individuals to interpret data, evaluate options, and act decisively. The more knowledge one gains, the more confidence accompanies every decision.

The Human Element in Financial Service

In an age dominated by algorithms, it is easy to forget that human connection remains essential. To truly lead with better service, financial professionals must prioritize empathy, transparency, and trust. Clients no longer accept vague promises—they seek guidance that is both personalized and actionable.

Listening carefully to concerns, simplifying complex information, and offering tailored solutions elevate financial services from transactional to transformational. This human touch, when combined with technological efficiency, creates a winning formula. Institutions that adopt this dual approach not only retain clients but also earn long-term loyalty.

Seizing Opportunities in a Digital Era

The digital era has democratized access to financial tools. What was once reserved for elite investors is now available to everyday earners with a smartphone. This accessibility represents a golden opportunity for growth.

Robo-advisors streamline investment decisions, mobile wallets simplify transactions, and peer-to-peer lending platforms unlock new financing options. Even cryptocurrency and blockchain technologies—once considered fringe—are now shaping mainstream finance. Embracing these innovations early positions individuals ahead of the curve.

Yet, caution remains key. Not every digital trend is sustainable, and careful evaluation ensures that enthusiasm does not overshadow practicality. Smart adoption of technology involves balancing excitement with due diligence.

Building a Sustainable Financial Future

Sustainability is not only an environmental concept; it is also a financial imperative. Decisions made today must support stability tomorrow. Creating emergency funds, maintaining healthy credit, and securing proper insurance are all pillars of a sustainable financial framework.

Sustainability also extends to lifestyle choices. Avoiding impulsive spending, maintaining clear boundaries between needs and wants, and adopting long-term investment mindsets all contribute to durability. A sustainable approach ensures that financial plans are not derailed by unexpected circumstances.

Thriving in the modern financial world requires more than luck—it demands strategy, discipline, and foresight. By focusing on winning in financial service, making today’s smart money moves, crafting enduring finance success strategies, and striving to lead with better service, individuals and institutions alike can navigate uncertainty with confidence.

The financial winners of tomorrow are not those who chase every fleeting opportunity but those who combine wisdom with innovation. The moves made today set the stage for lasting success, transforming money management from a chore into a craft, and ensuring prosperity that endures through every season of change.