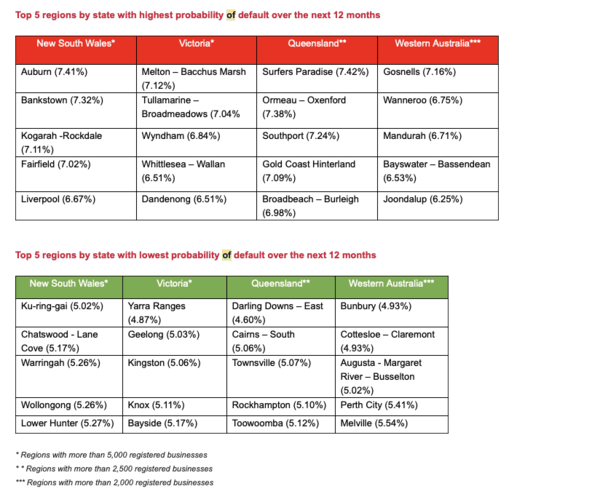

The hazard of default around the next 12 months has increased in all locations across Australia owing to labour shortages, mounting charges, curiosity amount hikes, and supply chain troubles.

The September 2022 CreditorWatch Business enterprise Chance Index (BRI) uncovered that the hazard of default about the upcoming 12 months has developed in all locations throughout Australia with 5000 or additional registered businesses, apart from New South Wales’ Decrease Hunter and Wyong areas. Organizations are having a tough time from the east coast to the west coastline.

Highlights:

- Court actions are up 60 per cent calendar year-on-year.

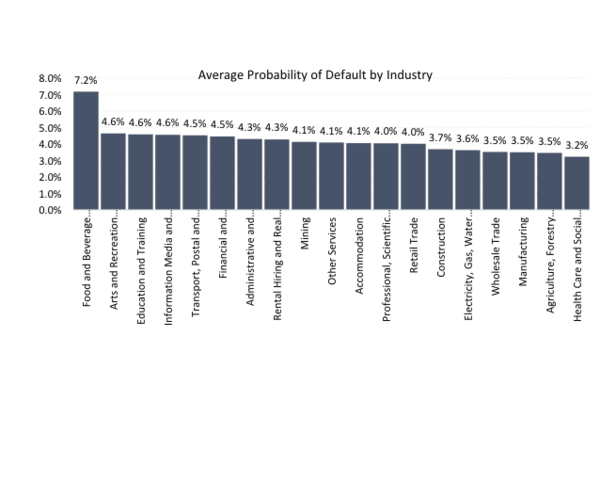

- The industries with the maximum chance of default more than the next 12 months are: Food stuff and Beverage Providers (7.20 for each cent) Arts and Recreation Services (4.68 for every cent) and Instruction and Coaching: (4.63 for each cent)

Trade activity nevertheless down

A extra encouraging advancement is that year-more than-yr progress in B2B trade receivables has ongoing to increase, which implies that small enterprises’ trade action has continued to improve considering that COVID. Nevertheless, figures are even now significantly below pre-covid concentrations.

Trade activity has been steadily falling for some time, but it is now rebounding to a lot more typical degrees. The details implies that there are still restrictions on how our clients are afflicted by actions that weren’t existing prior to Covid. These limitations commonly come from a deficiency of merchandise or a protracted delay in receiving them, in particular in the design marketplace, as well as labour constraints that prohibit enlargement or enterprises from doing the job at whole capacity.

For that reason, even although both countries’ labour power details are nevertheless very sparse, the information on open positions indicates that firms’ want to hire new personnel has decreased. The RBA is clearly remaining additional thorough in its technique to tightening financial policy as some indications get started to display that their income charge hikes are starting to have an effect. It may possibly just take some months prior to this slowdown starts off to present up in labour drive details.

CreditorWatch CEO Patrick Coghlan explained B2B trade payment defaults confirmed a dip this month however, these keep on being perfectly above amounts observed in September previous 12 months through Covid and are a direct indicator of future defaults.

“Payment defaults are massively significant and are a essential indicator of coming delinquency for the debtor/buyer. Close to 25% of enterprises with default stop up in administration within 12 months. In addition, it puts strain on the supplier, who will now have to shoulder that negative financial debt. A organization with a trade payment default is seven times the default threat as opposed to a organization with a thoroughly clean payment document.”

The big image

There has been a drop in the worth of the Australian dollar immediately after the central financial institution amazed buyers by deciding upon to elevate desire rates by a scaled-down-than-predicted quarter point.

The funds fee aim was lifted by 25 foundation points to 2.60 for each cent by the Reserve Lender of Australia. In addition, it elevated the desire charge on Exchange Settlement balances by 25 basis details to 2.50 for every cent.

What’s more, the Skills Precedence Record (SPL) found out that 286 positions are now in small source, up from 153 at the exact time in 2021. Nationally, shortages ranged from apiarists, veterinarians, nurses, and academics to scaffolders, specialists and trades personnel, miners, and landscape gardeners. Resort managers, bus drivers, blacksmiths, and elegance salon administrators are among the the noteworthy new additions to the expertise shortages.

ALSO Study: SME sentiment is weakening even with greater profitability. Here’s why

The announcement verifies numerous sector groups’ fears about the long-term competent workforce shortage impeding company activity across Australia.

Anneke Thompson, Chief Economist, CreditorWatch suggests: “Our Small business Risk Index (BRI) facts for September 2022 was broadly dependable with details trends we have recorded around the previous months. Trade Receivables continue on to maximize yearly, indicating that businesses are still emotion fairly self-assured and that provide and labour bottlenecks are slowly clearing up.

“This thirty day period we also saw the Reserve Lender of Australia (RBA) commence to move more cautiously through its monetary plan tightening cycle, with only a 25 bps raise in the cash level. Both equally regular Labour Drive and quarterly Career Emptiness information that were launched just lately instructed that the unemployment level may possibly have achieved its trough.

“The unemployment price increased extremely somewhat to 3.5 for every cent, from 3.4 per cent the month prior, though the amount of work opportunities obtainable decreased by 2 for each cent (or 10,000 jobs) around the 3 months to August. This will be welcome news for company entrepreneurs, most of whom have been having difficulties to uncover workers to meet demand from customers. It will also choose some stress off wage will increase. Continue to, occupation vacancies are at terribly high stages on prolonged-term steps, and it will just take numerous months to normalise.”

As a outcome of rising gasoline and food stuff price ranges, which have achieved a 20-calendar year significant, the Australian economic system is dealing with difficulties. This 12 months, the RBA has hiked charges six instances. While the RBA left the door open to a lot more hikes as it “assesses the prospective buyers for inflation and economic growth in Australia.”It claimed that it had opted to pause the speed of tightening for the reason that the cash level experienced been elevated noticeably in a quick interval of time.

Way forward

Inspite of favourable demand and trade situation for companies at the instant, analysts are nevertheless ready for customers to feel the results of interest charge will increase absolutely.

There are some early indications that, both equally domestically and around the globe, organization conditions have peaked. According to the latest Abdominal muscles Work Vacancy data, there have been much less jobs readily available in Australia in August than there have been in May. Equivalent developments might be observed in the data from the US.

So, whilst labour force details is nonetheless very limited in both nations around the world, the vacancy info indicates that careers are now starting to be crammed at a better amount, and firms have slowed their appetite for personnel.

It may take some months ahead of this slowdown starts to display up in labour power details, but obviously, the RBA is being more careful in their tactic to monetary coverage tightening as some indicators start out to display that their dollars rate hikes are setting up to just take effect.

Click here for CreditorWatch Business Risk Index report.

Click on here for further insights into the prime and finest performers.

Retain up to day with our stories on LinkedIn, Twitter, Facebook and Instagram.

More Stories

Oil Stocks Rally Despite Falling Prices. Why People Are Buying.

5 Super Simple Ways to Add Live Chat to Your Website for Free

Is HubSpot’s Email Marketing Tool Worth It?